Have questions about insurance ?

Let us provide you answers.

Collision and comprehensive coverages work together to cover the cost of repairing or replacing your car so that you won’t need to pay out-of-pocket expenses (except for your deductible).

Collision coverage is optional and covers the cost of repairing or replacing your car if it collides with another vehicle (or object), the ground, or an object in or on the ground (some examples are trees, road sign or guardrail). You will be required to pay a deductible.

Comprehensive coverage is optional and covers the cost of repairing or replacing your vehicle if it’s damaged by fire, theft or attempted theft, vandalism, falling or flying objects, a natural disaster, riot or civil disturbance.

Consider bundling your car and home insurance for discounts on both policies. Increasing your deductible can also lower your insurance premium. Maintaining a good driving history with no tickets or at fault accidents makes a big difference in how much you will pay. Some insurance companies offer discounts when you allow them to monitor your driving habits through an app – good driving behaviours = lower car insurance premiums.

We do not recommend that you stop or cancel your car insurance while you are away on vacation. However, when you are away for 45 days or more, you can suspend some of the insurance coverages and save some money while you are not driving or using the vehicle.

When you are not at fault for an accident, you are usually covered for a rental car. To ensure that you always have a rental car if an accident or other damage does occur, you want to ensure that you have Loss of Use coverage on your policy (usually identified as an endorsement form #20 in the coverage section).

Your liability insurance follows you everywhere in North America. Damage to a rental car would be covered by your car policy only if you have the additional coverage Liability for Non-Owned Automobiles (listed on your car policy as endorsement #27). You can add this coverage to your policy at any time.

Yes, you can! Depending on the insurance company, the discount could be as high as 15%!

Actual cash value means that depreciation will be applied to the damaged property when estimating how much will be paid out by the insurance company. Replacement cost allows for reimbursement of the cost necessary to replace the damaged property with similar type and quality.

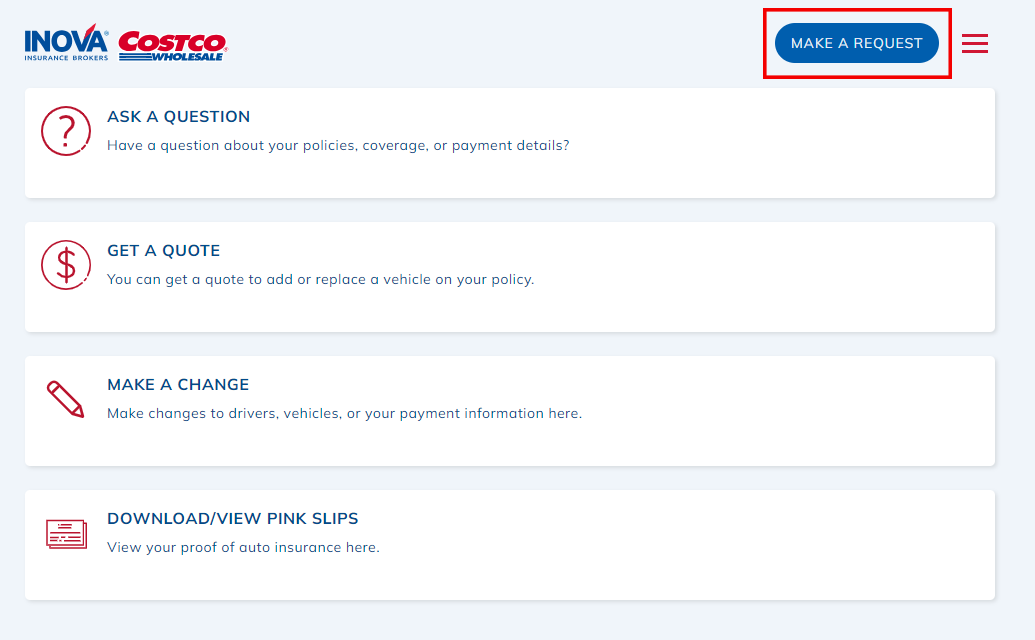

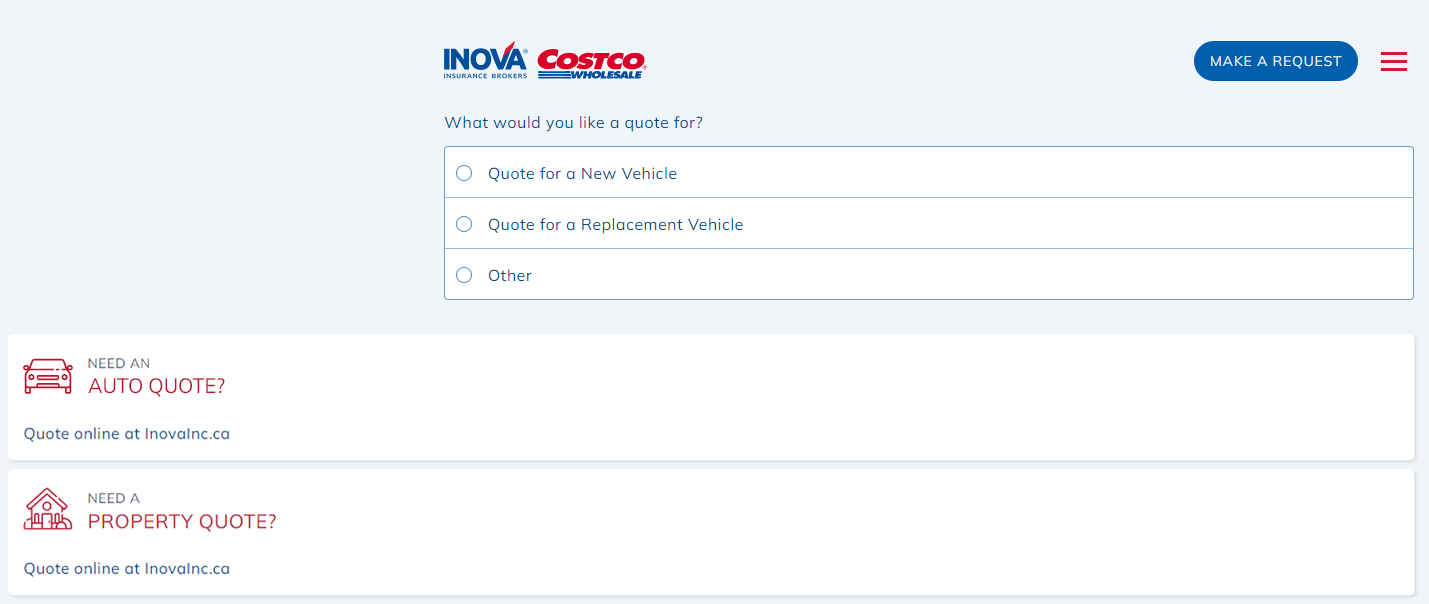

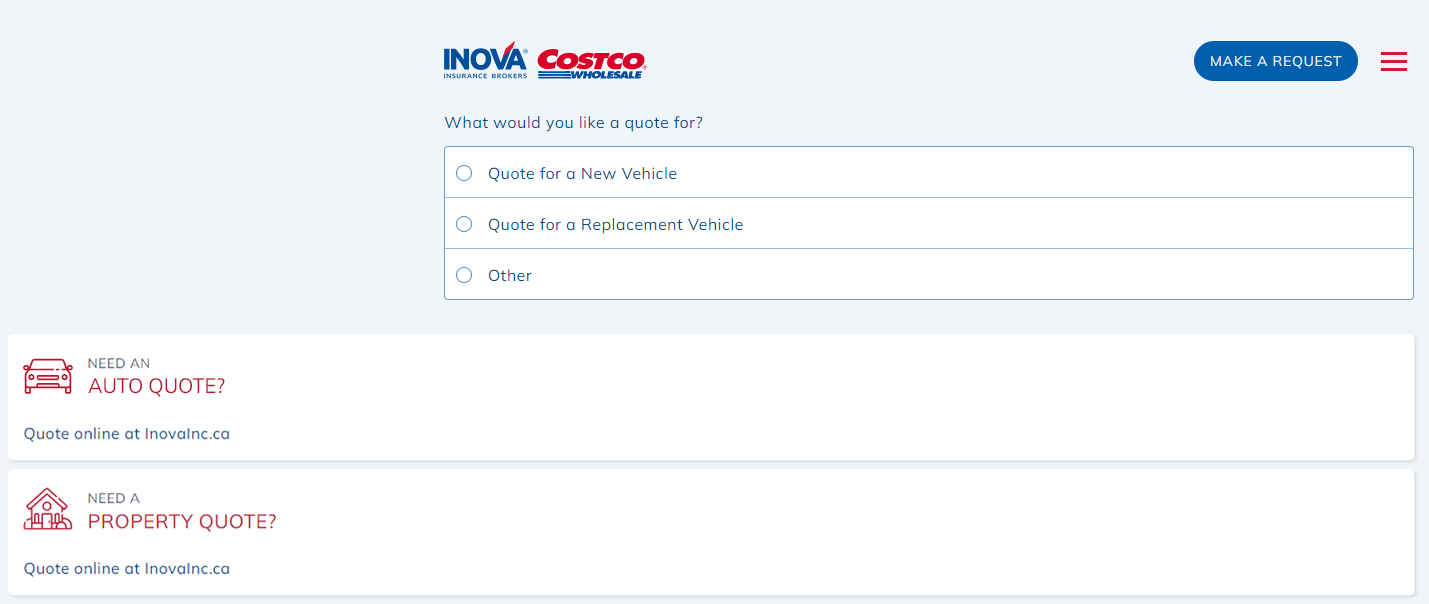

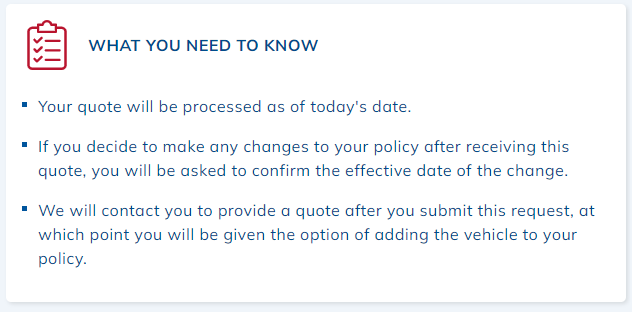

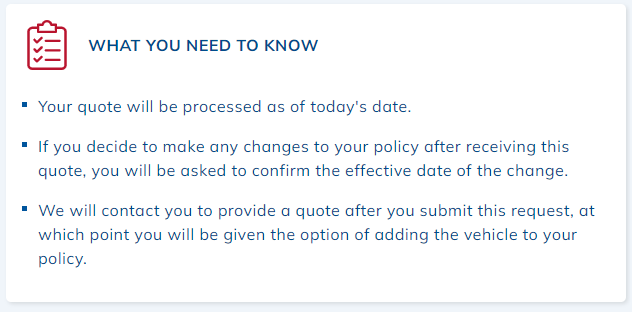

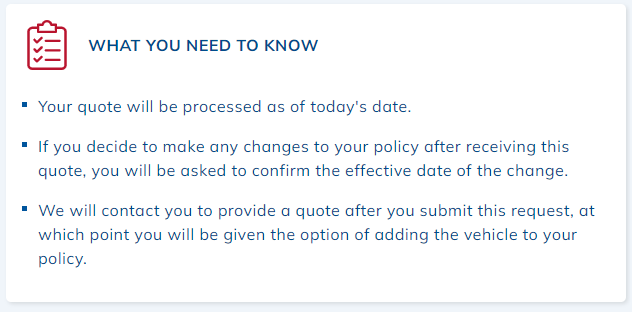

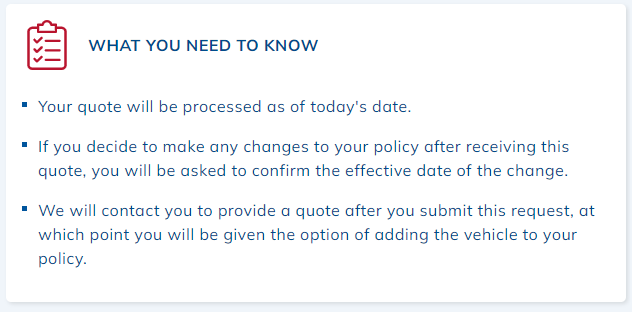

You can request a quote through myInova by selecting ‘Get a Quote’.

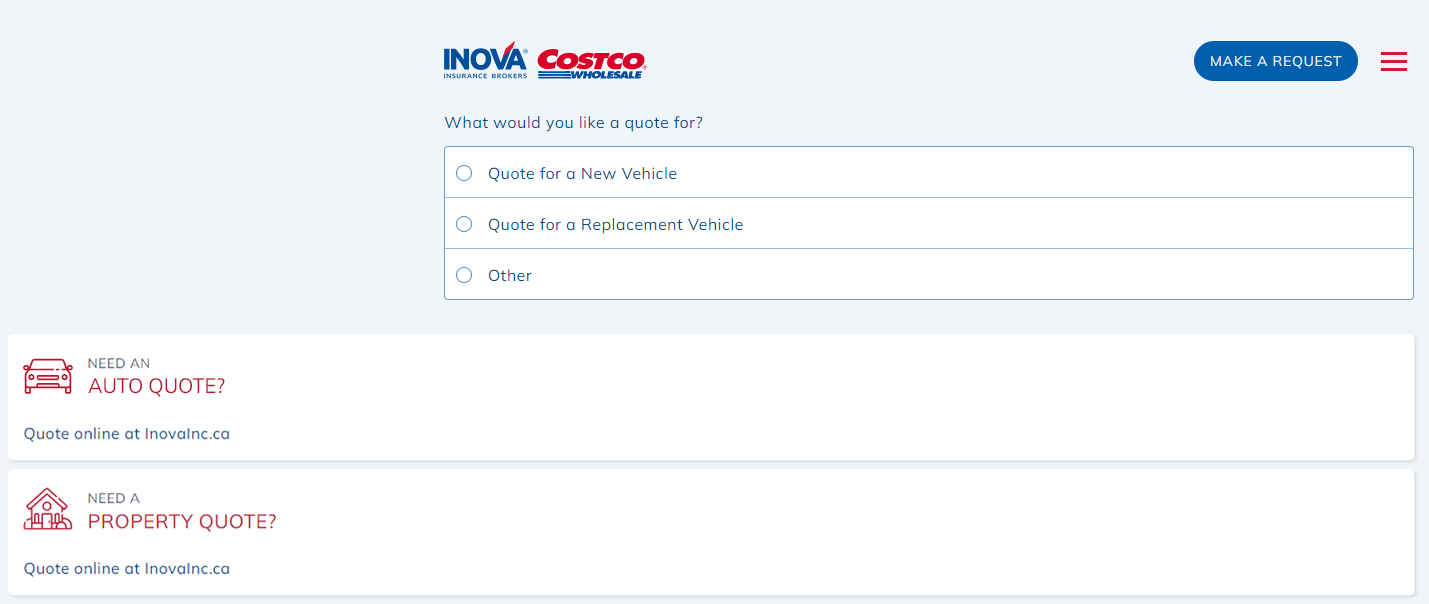

If you are shopping to replace your car, you need to select ‘Quote for a Replacement Vehicle’. If you are shopping to add a car to your policy, you will need to select ‘Quote for a New Vehicle’, regardless if the vehicle is new or used.

To ensure you are rewarded with all the savings you are entitled to, and that we have quoted the best possible price, one of our brokers will contact you to review within 1 to 2 business days.

Yes, you can! Depending on the insurance company, the discount could be as high as 15%!

Consider bundling your car and home insurance for discounts on both policies. Increasing your deductible can also lower your insurance premium. Consider installing a monitored burglar and/or fire alarm – most insurance companies offer good discounts for homes with security systems. Property maintenance is also very important, in particular your roof, plumbing, electrical and heating systems. Consider paying for small claims out of pocket to maintain your claims free discount and status.

If you unintentionally cause injury or property damage you could be held legally liable for the costs. Personal Liability protects your financial wellbeing from lawsuits if you are sued. Personal Liability protects you everywhere in the world. It is important to note that any liability claims arising from a car accident are covered under your car insurance policy and excluded from home insurance policies.

A real-life example of this would be a guest in your home is walking through your garage and a ladder falls on them. They suffer a broken leg and a broken arm that result in permanent injury. They decide to sue you for damages as they are no longer able to work.

It’s always a good idea to have someone checking on your home when you are away. You may also consider shutting off the water main.

During the regular heating season – most home policies have conditions requiring you to have someone checking on your home regularly and ensure that the water main is turned off at the source and all the pipes are drained as this will help avoid any water disasters should something unexpected happen.

This is the portion that you are responsible to pay in the event that an insured claim occurs. The insurance company pays costs over and above the deductible, subject to the policy or coverage limits.

A police report is not required most of the time. In the event of a hit and run, a theft or attempted theft, you should report the incident to the police.

As your broker, we are here to provide you advice and to assist and advocate for you during the claims process.

In most cases, your car insurance does not pay for damage or theft of your personal belongings, you need to have home insurance (homeowners, tenant or condo) for your personal belongings to be insured.

You must have collision coverage on your car policy to be covered for a Hit & Run. You should report the incident to the police within 24 hours of discovering the damage as many insurance companies require the police report when submitting a claim.

Windshield claims are generally covered under the comprehensive coverage of a car policy as the cause of the loss is usually flying objects (rocks or stones). You should contact one of the local glass/windshield repair shops in your community – they can usually handle the insurance claim for you.

Fault is determined by the insurance adjuster assigned to investigate and settle the claim. There are Fault Determination Regulations that are followed in each province.

Yes, it may impact your insurance premium. Some insurance companies offer Claims Protection coverage which forgives your first claim and treats it like it never happened. It varies depending on the insurer.

Go to the Claims page in the Help section.

We highly recommend that when possible, you pay for any small claims out of pocket. Home insurance is designed to protect your overall financial security, in particular large claims. When you make a claim, regardless of the amount, you will lose your claims free discounts and pay higher insurance premiums overall.

Acts of God and Natural Disasters are not automatically covered under a home policy. Events such as earthquake and flood must be specifically identified on the policy to be covered.

In the case of water damage, it is critical to identify and understand what caused the water damage. If it’s a leaky pipe, you’re not likely covered as home insurance covers sudden and accidental losses – leaks that occur over a period of time are simply not covered by home insurance policies. If you’re unsure, your best bet is to contact a property restoration company in your community to get an assessment. They can assist you in responding to the immediate situation, mitigating further damage and providing you with an assessment of what caused the water in the first place.

Collision and comprehensive coverages work together to cover the cost of repairing or replacing your car so that you won’t need to pay out-of-pocket expenses (except for your deductible).

Collision coverage is optional and covers the cost of repairing or replacing your car if it collides with another vehicle (or object), the ground, or an object in or on the ground (some examples are trees, road sign or guardrail). You will be required to pay a deductible.

Comprehensive coverage is optional and covers the cost of repairing or replacing your vehicle if it’s damaged by fire, theft or attempted theft, vandalism, falling or flying objects, a natural disaster, riot or civil disturbance.

Consider bundling your car and home insurance for discounts on both policies. Increasing your deductible can also lower your insurance premium. Maintaining a good driving history with no tickets or at fault accidents makes a big difference in how much you will pay. Some insurance companies offer discounts when you allow them to monitor your driving habits through an app – good driving behaviours = lower car insurance premiums.

We do not recommend that you stop or cancel your car insurance while you are away on vacation. However, when you are away for 45 days or more, you can suspend some of the insurance coverages and save some money while you are not driving or using the vehicle.

When you are not at fault for an accident, you are usually covered for a rental car. To ensure that you always have a rental car if an accident or other damage does occur, you want to ensure that you have Loss of Use coverage on your policy (usually identified as an endorsement form #20 in the coverage section).

Your liability insurance follows you everywhere in North America. Damage to a rental car would be covered by your car policy only if you have the additional coverage Liability for Non-Owned Automobiles (listed on your car policy as endorsement #27). You can add this coverage to your policy at any time.

Yes, you can! Depending on the insurance company, the discount could be as high as 15%!

Actual cash value means that depreciation will be applied to the damaged property when estimating how much will be paid out by the insurance company. Replacement cost allows for reimbursement of the cost necessary to replace the damaged property with similar type and quality.

You can request a quote through myInova by selecting ‘Get a Quote’.

If you are shopping to replace your car, you need to select ‘Quote for a Replacement Vehicle’. If you are shopping to add a car to your policy, you will need to select ‘Quote for a New Vehicle’, regardless if the vehicle is new or used.

To ensure you are rewarded with all the savings you are entitled to, and that we have quoted the best possible price, one of our brokers will contact you to review within 1 to 2 business days.

Yes, you can! Depending on the insurance company, the discount could be as high as 15%!

Consider bundling your car and home insurance for discounts on both policies. Increasing your deductible can also lower your insurance premium. Consider installing a monitored burglar and/or fire alarm – most insurance companies offer good discounts for homes with security systems. Property maintenance is also very important, in particular your roof, plumbing, electrical and heating systems. Consider paying for small claims out of pocket to maintain your claims free discount and status.

If you unintentionally cause injury or property damage you could be held legally liable for the costs. Personal Liability protects your financial wellbeing from lawsuits if you are sued. Personal Liability protects you everywhere in the world. It is important to note that any liability claims arising from a car accident are covered under your car insurance policy and excluded from home insurance policies.

A real-life example of this would be a guest in your home is walking through your garage and a ladder falls on them. They suffer a broken leg and a broken arm that result in permanent injury. They decide to sue you for damages as they are no longer able to work.

It’s always a good idea to have someone checking on your home when you are away. You may also consider shutting off the water main.

During the regular heating season – most home policies have conditions requiring you to have someone checking on your home regularly and ensure that the water main is turned off at the source and all the pipes are drained as this will help avoid any water disasters should something unexpected happen.

This is the portion that you are responsible to pay in the event that an insured claim occurs. The insurance company pays costs over and above the deductible, subject to the policy or coverage limits.

A police report is not required most of the time. In the event of a hit and run, a theft or attempted theft, you should report the incident to the police.

As your broker, we are here to provide you advice and to assist and advocate for you during the claims process.

In most cases, your car insurance does not pay for damage or theft of your personal belongings, you need to have home insurance (homeowners, tenant or condo) for your personal belongings to be insured.

You must have collision coverage on your car policy to be covered for a Hit & Run. You should report the incident to the police within 24 hours of discovering the damage as many insurance companies require the police report when submitting a claim.

Windshield claims are generally covered under the comprehensive coverage of a car policy as the cause of the loss is usually flying objects (rocks or stones). You should contact one of the local glass/windshield repair shops in your community – they can usually handle the insurance claim for you.

Fault is determined by the insurance adjuster assigned to investigate and settle the claim. There are Fault Determination Regulations that are followed in each province.

Yes, it may impact your insurance premium. Some insurance companies offer Claims Protection coverage which forgives your first claim and treats it like it never happened. It varies depending on the insurer.

Go to the Claims page in the Help section.

We highly recommend that when possible, you pay for any small claims out of pocket. Home insurance is designed to protect your overall financial security, in particular large claims. When you make a claim, regardless of the amount, you will lose your claims free discounts and pay higher insurance premiums overall.

Acts of God and Natural Disasters are not automatically covered under a home policy. Events such as earthquake and flood must be specifically identified on the policy to be covered.

In the case of water damage, it is critical to identify and understand what caused the water damage. If it’s a leaky pipe, you’re not likely covered as home insurance covers sudden and accidental losses – leaks that occur over a period of time are simply not covered by home insurance policies. If you’re unsure, your best bet is to contact a property restoration company in your community to get an assessment. They can assist you in responding to the immediate situation, mitigating further damage and providing you with an assessment of what caused the water in the first place.