Have questions about insurance ?

Let us provide you answers.

When you request that your policy be cancelled on the renewal date there is no penalty or additional fees. When you request a cancellation in the middle of the policy term, there is an administration fee applied to the cancellation.

If you unintentionally cause injury or property damage you could be held legally liable for the costs. Personal Liability protects your financial wellbeing from lawsuits if you are sued. Personal Liability protects you everywhere in the world. It is important to note that any liability claims arising from a car accident are covered under your car insurance policy and excluded from home insurance policies.

A real-life example of this would be a guest in your home is walking through your garage and a ladder falls on them. They suffer a broken leg and a broken arm that result in permanent injury. They decide to sue you for damages as they are no longer able to work.

It’s always a good idea to have someone checking on your home when you are away. You may also consider shutting off the water main.

During the regular heating season – most home policies have conditions requiring you to have someone checking on your home regularly and ensure that the water main is turned off at the source and all the pipes are drained as this will help avoid any water disasters should something unexpected happen.

Increasing your deductible can lower your insurance premium. Consider installing a monitored burglar and/or fire alarm – most insurance companies offer good discounts for homes with security systems. Property maintenance is also very important, in particular your roof, plumbing, electrical and heating systems. Consider paying for small claims out of pocket to maintain your claims free discount and status.

This is the portion that you are responsible to pay in the event that an insured claim occurs. The insurance company pays costs over and above the deductible, subject to the policy or coverage limits.

A police report is not required most of the time. In the event of a theft or attempted theft, you should report the incident to the police.

As your broker, we are here to provide you advice and to assist and advocate for you during the claims process.

Go to the Claims page in the Help section.

We highly recommend that when possible, you pay for any small claims out of pocket. Home insurance is designed to protect your overall financial security, in particular large claims. When you make a claim, regardless of the amount, you will lose your claims free discounts and pay higher insurance premiums overall.

Acts of God and Natural Disasters are not automatically covered under a home policy. Events such as earthquake and flood must be specifically identified on the policy to be covered.

In the case of water damage, it is critical to identify and understand what caused the water damage. If it’s a leaky pipe, you’re not likely covered as home insurance covers sudden and accidental losses – leaks that occur over a period of time are simply not covered by home insurance policies. If you’re unsure, your best bet is to contact a property restoration company in your community to get an assessment. They can assist you in responding to the immediate situation, mitigating further damage and providing you with an assessment of what caused the water in the first place.

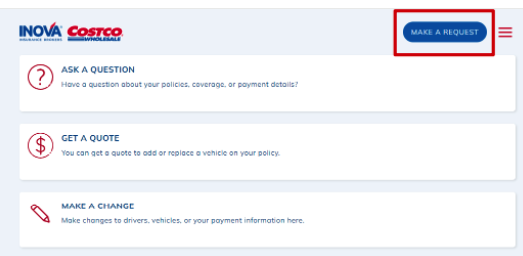

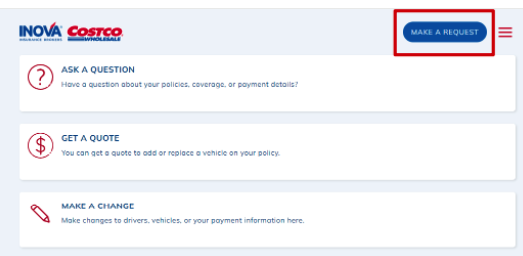

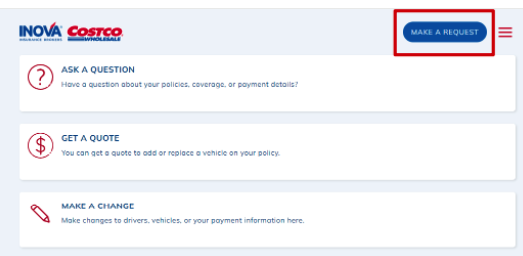

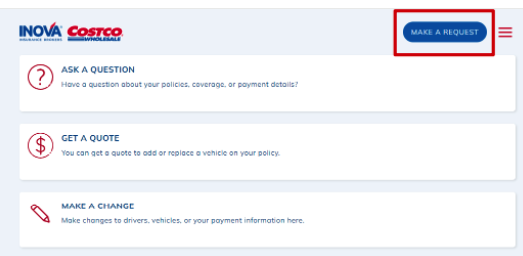

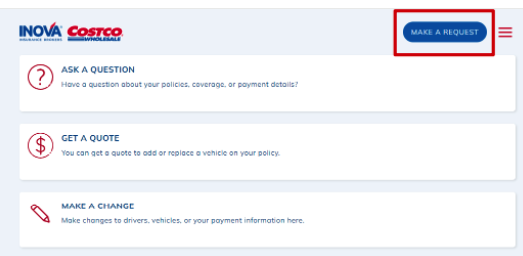

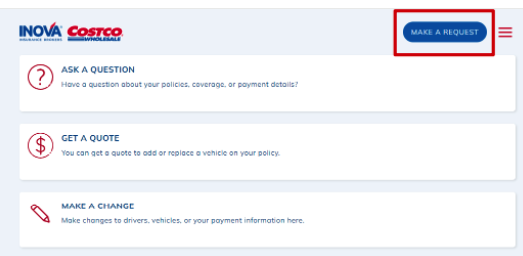

myInova is a quick and easy way to access to your insurance account online – at a time that is convenient for you 24/7!

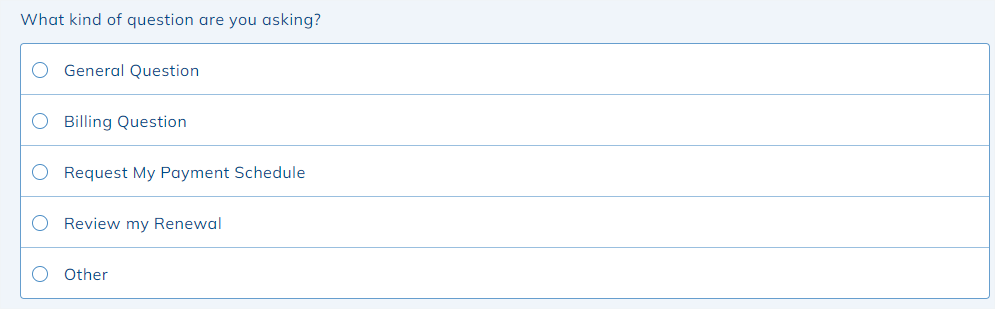

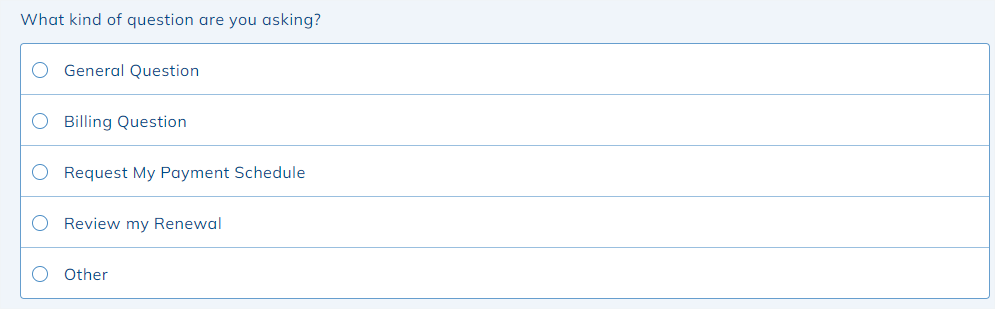

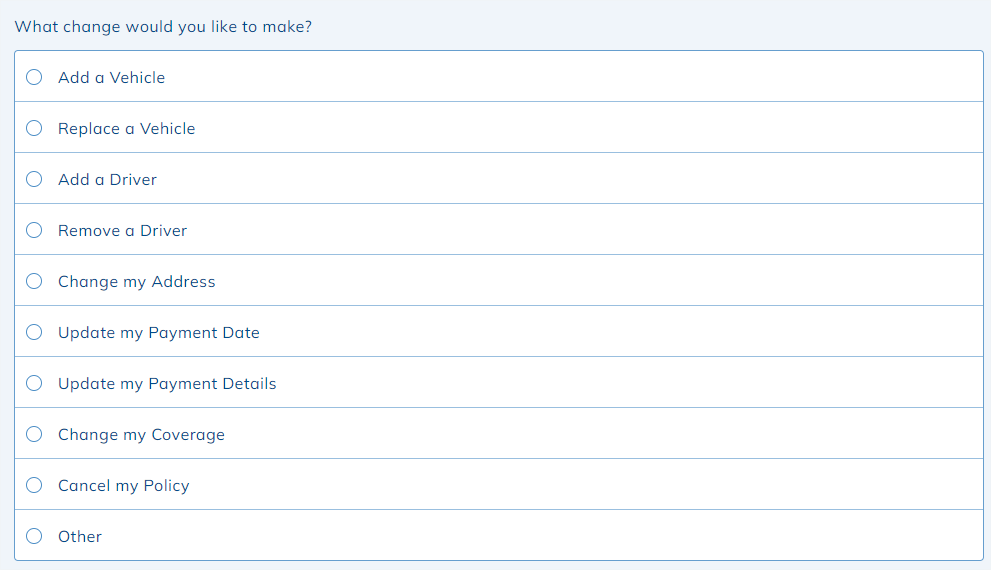

You can also submit a question by selecting from the list of choices below:

If your inquiry is not urgent, we highly recommend you use this method over the phone lines as the response times can be longer than expected.

Requests coming through myInova will usually be completed within 2-4 business days, depending on the nature of the change to your policy. You will receive a confirmation email for the requested changes, which make the changes official.

Registering for myInova is quick and takes just a few minutes; all you need is your email address and policy number! You can use the same log in for multiple cars and home policies.

Once you’ve signed in to myInova, the information you will see there is your personalized account info with all your policies. You can :

-

- consult your policy coverage;

- display your effective and expiry dates;

- see the subject of insurance.

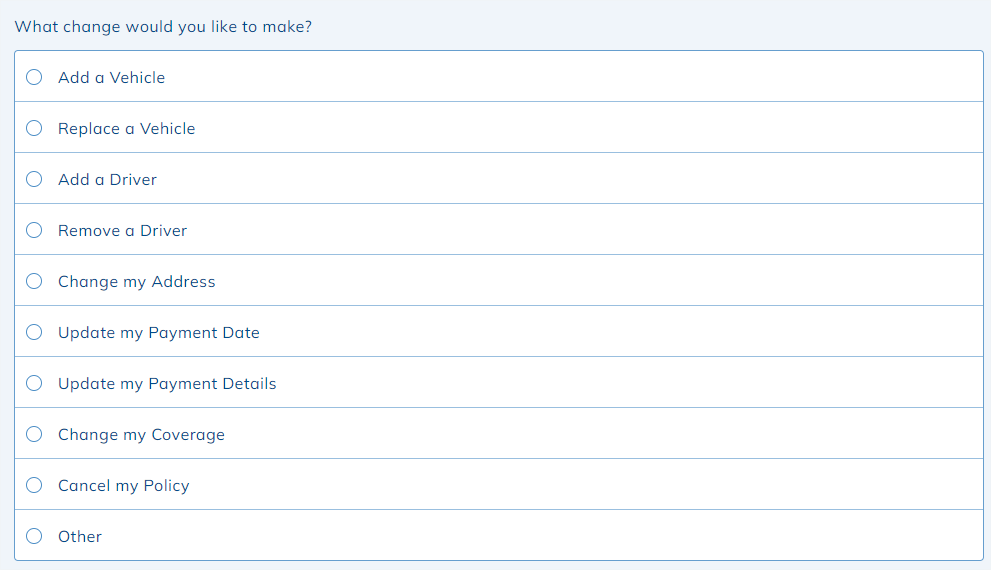

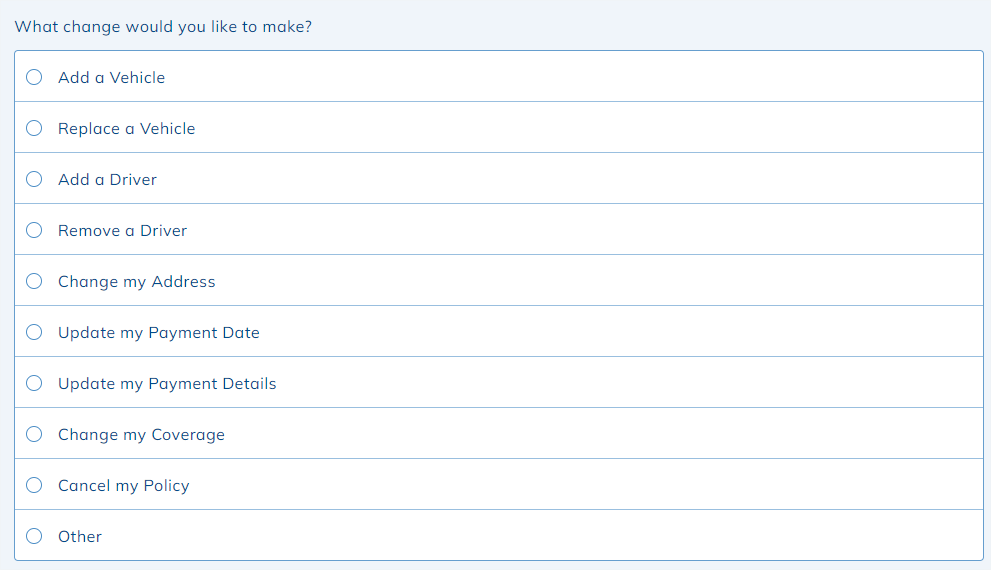

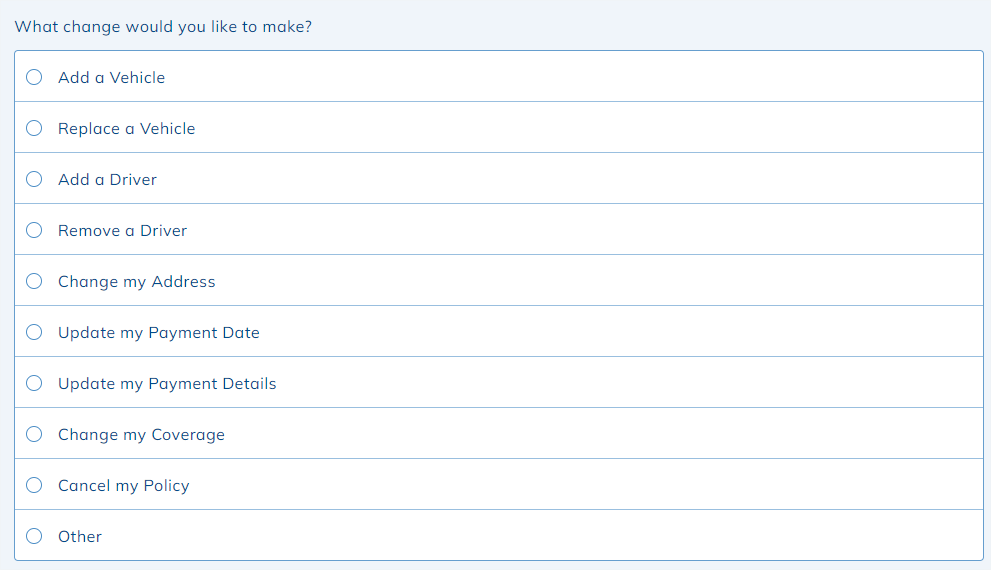

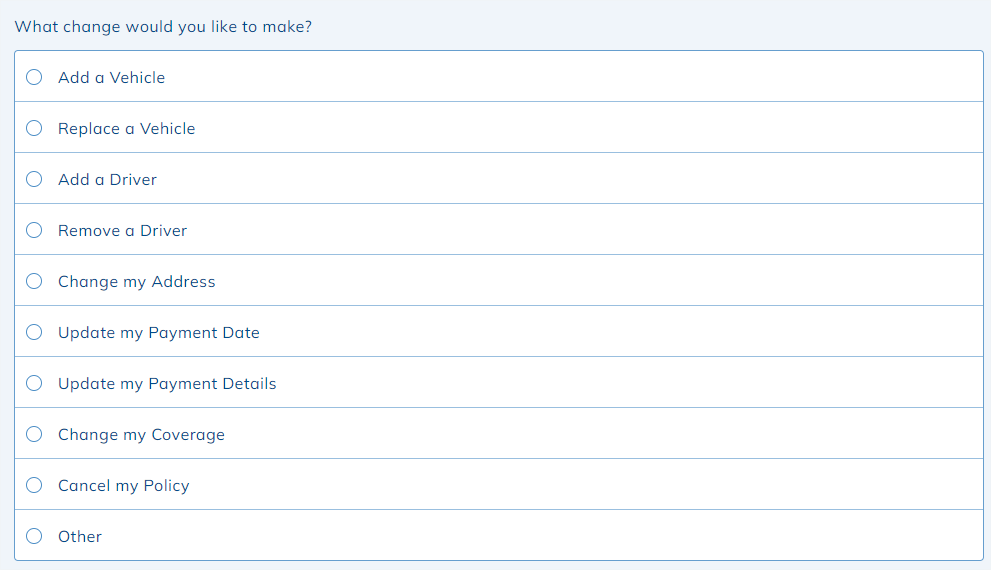

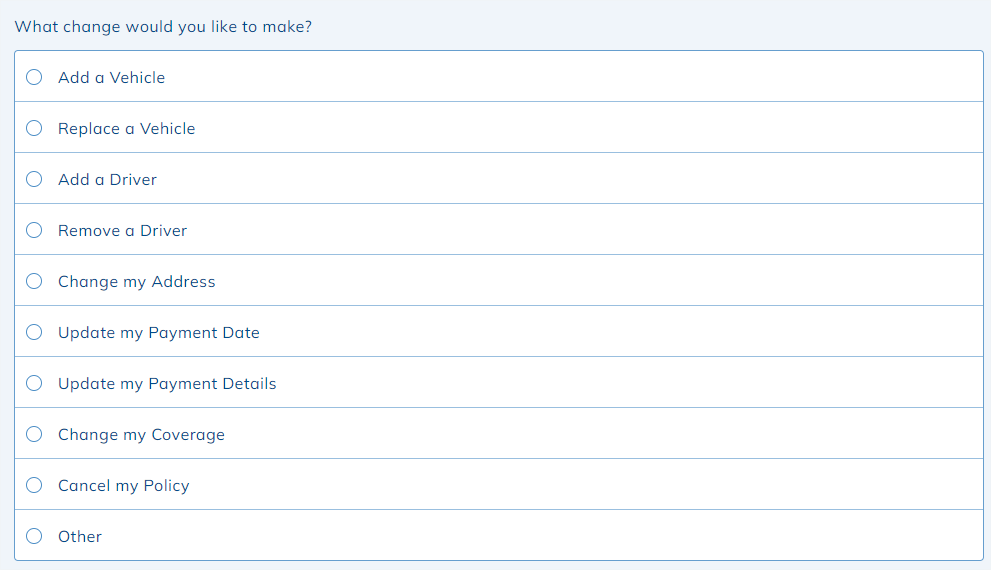

You can use myInova to make a request for a variety of changes to your home insurance policy! If you cannot find the category of the request you are looking for from the list within myInova, simply select ‘other’ and a text box will open for you to indicate the change you would like to make.

You can request a change of address through myInova – all you need handy is your new address, postal code, and the date you are moving in. Please note a change of address may impact the premium of your car and home policies.

Yes, changing your address can impact the price of your home insurance policy – your postal code, commuting distance, and the details of the new address are all considered when determining premium.

It is always best to advise us of any improvements or updates you have completed to your home, so your information remains up to date. You can choose ‘Change Coverage’ from the list of categories and a text box will appear for you to indicate what you’ve updated.

Requests coming through myInova will usually be completed within 2-4 business days, depending on the nature of the change to your policy. You will receive a confirmation email for the requested changes, which make the changes official.

When you request that your policy be cancelled on the renewal date there is no penalty or additional fees. When you request a cancellation in the middle of the policy term, there is an administration fee applied to the cancellation.

If you unintentionally cause injury or property damage you could be held legally liable for the costs. Personal Liability protects your financial wellbeing from lawsuits if you are sued. Personal Liability protects you everywhere in the world. It is important to note that any liability claims arising from a car accident are covered under your car insurance policy and excluded from home insurance policies.

A real-life example of this would be a guest in your home is walking through your garage and a ladder falls on them. They suffer a broken leg and a broken arm that result in permanent injury. They decide to sue you for damages as they are no longer able to work.

It’s always a good idea to have someone checking on your home when you are away. You may also consider shutting off the water main.

During the regular heating season – most home policies have conditions requiring you to have someone checking on your home regularly and ensure that the water main is turned off at the source and all the pipes are drained as this will help avoid any water disasters should something unexpected happen.

Increasing your deductible can lower your insurance premium. Consider installing a monitored burglar and/or fire alarm – most insurance companies offer good discounts for homes with security systems. Property maintenance is also very important, in particular your roof, plumbing, electrical and heating systems. Consider paying for small claims out of pocket to maintain your claims free discount and status.

This is the portion that you are responsible to pay in the event that an insured claim occurs. The insurance company pays costs over and above the deductible, subject to the policy or coverage limits.

A police report is not required most of the time. In the event of a theft or attempted theft, you should report the incident to the police.

As your broker, we are here to provide you advice and to assist and advocate for you during the claims process.

Go to the Claims page in the Help section.

We highly recommend that when possible, you pay for any small claims out of pocket. Home insurance is designed to protect your overall financial security, in particular large claims. When you make a claim, regardless of the amount, you will lose your claims free discounts and pay higher insurance premiums overall.

Acts of God and Natural Disasters are not automatically covered under a home policy. Events such as earthquake and flood must be specifically identified on the policy to be covered.

In the case of water damage, it is critical to identify and understand what caused the water damage. If it’s a leaky pipe, you’re not likely covered as home insurance covers sudden and accidental losses – leaks that occur over a period of time are simply not covered by home insurance policies. If you’re unsure, your best bet is to contact a property restoration company in your community to get an assessment. They can assist you in responding to the immediate situation, mitigating further damage and providing you with an assessment of what caused the water in the first place.

myInova is a quick and easy way to access to your insurance account online – at a time that is convenient for you 24/7!

You can also submit a question by selecting from the list of choices below:

If your inquiry is not urgent, we highly recommend you use this method over the phone lines as the response times can be longer than expected.

Requests coming through myInova will usually be completed within 2-4 business days, depending on the nature of the change to your policy. You will receive a confirmation email for the requested changes, which make the changes official.

Registering for myInova is quick and takes just a few minutes; all you need is your email address and policy number! You can use the same log in for multiple cars and home policies.

Once you’ve signed in to myInova, the information you will see there is your personalized account info with all your policies. You can :

-

- consult your policy coverage;

- display your effective and expiry dates;

- see the subject of insurance.

You can use myInova to make a request for a variety of changes to your home insurance policy! If you cannot find the category of the request you are looking for from the list within myInova, simply select ‘other’ and a text box will open for you to indicate the change you would like to make.

You can request a change of address through myInova – all you need handy is your new address, postal code, and the date you are moving in. Please note a change of address may impact the premium of your car and home policies.

Yes, changing your address can impact the price of your home insurance policy – your postal code, commuting distance, and the details of the new address are all considered when determining premium.

It is always best to advise us of any improvements or updates you have completed to your home, so your information remains up to date. You can choose ‘Change Coverage’ from the list of categories and a text box will appear for you to indicate what you’ve updated.

Requests coming through myInova will usually be completed within 2-4 business days, depending on the nature of the change to your policy. You will receive a confirmation email for the requested changes, which make the changes official.